Top Finance Companies Dominating the Industry Finacial Ascendancy

- In today’s fast-paced and ever-evolving financial landscape, identifying the institutions that stand at the forefront of innovation and excellence is crucial for success. Whether you’re an individual investor seeking robust financial solutions or a business owner in pursuit of strategic partnerships, aligning yourself with the top finance companies can pave the way for sustainable growth and prosperity. These trailblazers not only possess a wealth of experience and expertise but also demonstrate a commitment to pushing boundaries and embracing change. Join me as we delve into the world of finance and shine a spotlight on the companies that are shaping the future of the industry, one innovative solution at a time.

Introduction:

- The realm of finance is not merely about numbers and transactions; it’s about trust, reliability, and the power to drive meaningful change. From managing investments to facilitating global transactions, finance companies play a pivotal role in shaping the economic landscape and empowering individuals and businesses to achieve their goals. Yet, amidst the multitude of options available, discerning the crème de la crème of finance companies requires a keen understanding of industry trends, digital market dynamics, and customer needs. In this blog, we’ll embark on a journey to uncover the top finance companies that are redefining the standards of excellence and setting the stage for a brighter financial future.

Table of Contents

1.Goldman Sachs:

- Renowned for its prestigious reputation and unparalleled expertise, Goldman Sachs is a global leader in investment banking, asset management, and financial services. With a legacy spanning over a century, this esteemed institution has consistently ranked among the top finance companies, offering innovative solutions and strategic insights to clients worldwide.

2.JPMorgan Chase:

- As one of the largest and most influential financial institutions in the world, JPMorgan Chase boasts a comprehensive suite of services spanning investment banking, asset management, and consumer banking. Leveraging cutting-edge technology and a vast network of resources, JPMorgan Chase continues to drive innovation and deliver superior value to its clients.

3.BlackRock:

- BlackRock stands at the forefront of asset management, with a focus on providing tailored investment solutions to institutional and individual investors. With a commitment to sustainability and responsible investing, BlackRock is not only shaping the future of finance but also making a positive impact on society and the environment.

4.Vanguard Group:

- Vanguard Group is synonymous with low-cost index investing, offering a wide range of mutual funds and exchange-traded funds (ETFs) designed to help investors achieve their long-term financial goals. With a client-first approach and a commitment to transparency, Vanguard Group has earned the trust and loyalty of millions of investors worldwide.

5.Fidelity Investments:

- Fidelity Investments is a household name in the world of personal finance, offering a diverse range of investment products, retirement planning services, and wealth management solutions. With a focus on innovation and customer-centricity, Fidelity Investments continues to empower individuals to take control of their financial futures.

Goldman Sachs:

- Founded in 1869, Goldman Sachs is one of the world’s largest investment banks.

- It offers a wide range of financial services, including investment banking, asset management, securities, and prime brokerage.

- Goldman Sachs is known for its prestigious reputation, high-profile clients, and influential role in global finance.

- The company has offices in major financial centers worldwide and employs thousands of professionals across various disciplines.

JPMorgan Chase:

- JPMorgan Chase is known for its strong balance sheet, extensive client base, and innovative approach to finance.

- The company traces its roots back to 1799 and has grown to become one of the largest banks in the United States and globally.

BlackRock:

- BlackRock is the world’s largest asset management firm, with over $9 trillion in assets under management.

- It offers a diverse range of investment products, including mutual funds, ETFs, and alternative investments.

- BlackRock is known for its focus on sustainable investing and corporate governance, making it a leader in responsible investing.

- The company was founded in 1988 and has since grown to become a dominant force in the global financial industry.

Vanguard Group:

- It is known for pioneering low-cost index investing and popularizing the concept of passive investing.

- Vanguard offers a wide range of mutual funds and ETFs designed to help investors achieve their long-term financial goals.

- The company operates on a client-owned structure, meaning it is owned by its funds and, in turn, by its investors.

- Fidelity Investments:

Fidelity Investments:

- It offers a range of services, including investment management, retirement planning, wealth management, and life insurance.

- Fidelity is known for its online brokerage platform, Fidelity Investments, and its robust suite of investment products and tools.

- The company was founded in 1946 and has since grown to become one of the largest and most respected financial services firms in the world.

- These finance companies play integral roles in the global financial ecosystem, providing essential services and solutions to individuals, businesses, and institutions worldwide.

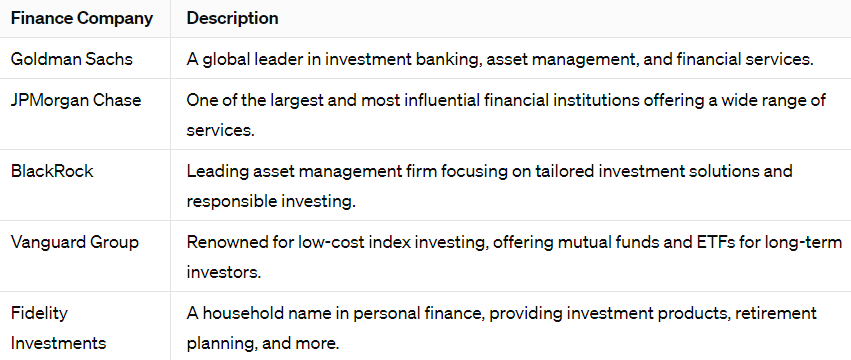

Top Finance companies

Conclusion:

- In a world where financial stability and security are paramount, aligning yourself with the top finance companies can provide a solid foundation for achieving your monetary goals and aspirations. Whether you’re seeking investment advice, wealth management services, or strategic partnerships, these trailblazers in the finance industry offer the expertise, innovation, and reliability needed to navigate the complexities of today’s financial landscape with confidence and peace of mind. So take the time to research and explore your options, and make an informed decision that sets you on the path towards financial prosperity and success.